Summary

A leading clothing manufacturer distributor and retailer of clothing realized they needed to fortify their pricing decisions with machine learning insights.

Take Our Content to Go

Competing in Today’s Retail Landscape

Companies like Amazon and Walmart have completely flipped the script on consumer expectations. Today’s customers expect personalized offers and deals, and if your firm isn’t providing them this, you will likely lose your wallet share. Responsive retail has peaked, and the world is entering the era of predictive commerce. This shift requires designing experiences that merge an understanding of human behavior with large-scale automation and data integration.

How is this done? It begins by embracing the application of machine learning to forecast demand, dynamically recommend products, and set prices at the individual consumer level. To stay competitive in today’s retail landscape, retail executives must think more like tech companies, but many retailers lack the artificial intelligence and machine learning expertise that these other companies have.

If Retailers need to act more like tech firms, then they face the very competitive and volatile data science job market. Not only is it incredibly resource intensive to hire these people but retaining them with interesting work and competitive compensation is even harder. Outsourcing machine learning and artificial intelligence development is often more profitable, especially if you can build a long-term relationship with the data science services firm.

Mosaic helped solve this problem for an iconic American retailer that was losing data scientists to large tech companies and becoming a trusted partner in keeping their robust enterprise pricing and customer systems enhanced with machine learning-driven insights. The following case study illustrates how Mosaic was able to provide value by accommodating varied data science techniques and specialties as project requirements shifted, helping the firm set profitable clearance prices while maintaining a consistent customer experience.

The need for ML-Driven Pricing

Traditional retail pricing schemes for sales are based on a combination of the rate of sales and inventory on hand. Volume and profit goals typically inform price setting; models tying price to demand can quickly become overwhelmingly complex, and therefore many retail outlets fall back on simple, uncontrolled demand modeling. Such was just the situation for Mosaic’s retail clothing client: they knew that there were more variables influencing consumer behavior than they were currently accounting for in their baseline demand models.

Additionally, they wanted to optimize the pricing mix across hundreds of items to maximize profit margin and sales volume. In response, Mosaic built a multi-phased model that predicts demand at the item level and optimizes the pricing mix while accounting for potentially limiting elements like inventory drawdown.

Predictive Pricing Model Development

The final Price Optimization Model consists of three distinct phases:

- Item-level demand forecasts through the sales period;

- Projected item-level inventory restrictions on demand (not enough inventory to meet projected demand);

- Pricing mix optimization at the item-level based on the projected inventory restricted sales and associated cost of goods.

Each phase of the model required a substantial amount of data cleaning and evaluation of multiple different data flows and potential applications. Ultimately, Mosaic ended up ingesting data from item transaction history, item fit and category information, historical promotional activity, historical marketing spend, and email offers, and existing inventory levels along with inventory still in transit at the time the projection were being made.

Phase 1 | ML Demand Forecasting Refresh

The baseline demand forecast drives all other components of the Price Optimization Model. It was therefore important to account for as many key drivers of consumer purchasing behavior as possible, which in turn required a model capable of doing so. Initial explorations of panel approaches and simple log-log elasticity regression models were ultimately dismissed in favor of a Bayesian structural time series (BSTS) algorithm.

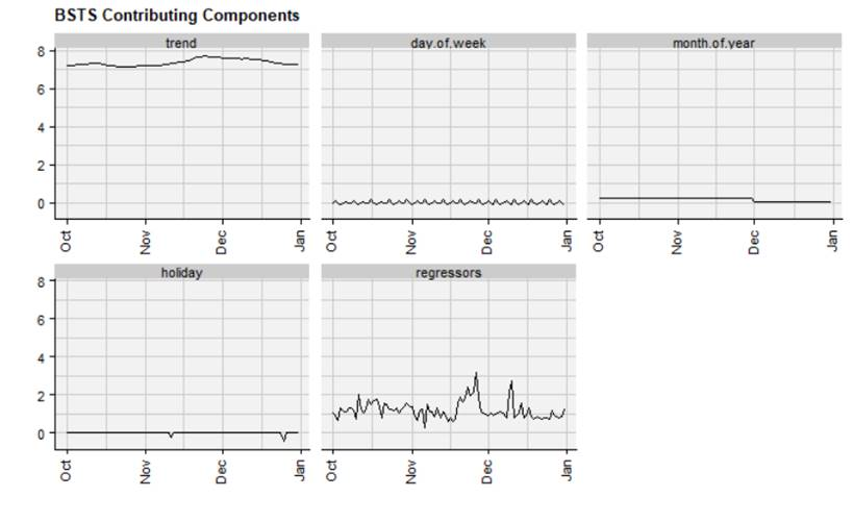

As do most time series specific algorithms, BSTS models dissect the historical data flow into trend, seasonality and the influences of external regressions. The final demand model therefore controls for day-of-week seasonality, month-of-year seasonality, the specific impact of both individual holidays and holiday “periods” (e.g. the weeks leading up to Christmas – a particularly key time period for retailers), and elements such as marketing spend and specific types of promotions. Further, Mosaic was able to take advantage of the Bayesian nature of the algorithm to specifically tune how reactive the model should be to information or sudden potential changes in the underlying structure of the data. This is particularly useful for evaluating data for companies that may have either changed large scale promotional or other strategies during the historical time span in question, or encountered data feed issues. Both were true for Mosaic’s client.

To add another wrinkle to the overall process, Mosaic could not actually use a straightforward forecast from the BSTS model. This occurred because the item histories existed for the items in a regular price structure, while the sale converted these items to a clearance price structure. Prior analysis showed that the two pricing structures had very different responses to promotions and marketing influences.

To account for this discrepancy, Mosaic built two demand models: one for regular price structure from which to pull a baseline trend, and another for the clearance price structure from which to pull comparable item elasticities and related coefficients. In this way, Mosaic was able to build an item-specific demand forecast for clearance items that had never been on clearance before. That forecast accounted for day-of-week, week-of-year and holiday effects, as well as promotional and marketing activities that occurred during the sales period.

Phase 2 | Factoring Inventory Restriction

In a retail sales environment, it can be difficult to match demand to inventory, and items will sell out before demand is saturated. Therefore, Mosaic had to incorporate this restriction on the demand forecasts. Doing so required distributing the predicted demand across all sizes for a sale item, which was guided by established “size curves” that represent the proportional demand for the different item sizes. Then, available inventory counts were applied to the size-distributed demand. This prevents the optimization phase from optimizing price mix on demand for which no inventory exists.

Phase 3 | Price Mix Optimization

The price optimization algorithm is a greedy search algorithm. It uses the inventory-constrained demand predictions along with the item unit cost and finds the combination of item prices that will maximize the profit margin. The optimizer concurrently assures that prices are set at a level to ensure that volume goals can be met (or exceeded).

After the final optimization phase for the sale in question, the client received a detailed breakdown of pricing and sales projections for each item in the sale. These prices were loaded into their enterprise pricing system, and users were presented with an automatic price setting for a major clearance sale. Not only does this custom machine learning tool boost profit margins, it saves the pricing team countless man hours via analytics automation. The team does not have to spend as much time cranking out different scenarios.

Results

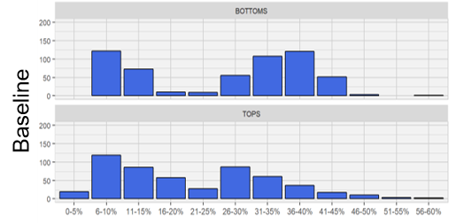

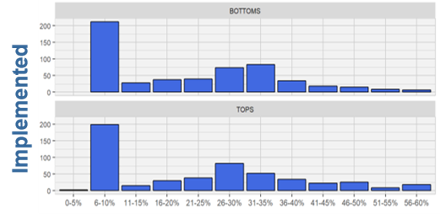

Mosaic was able to leverage a retail client’s historical promotion and transaction data to build a price optimization tool that successfully set prices for a major clearance sale and is currently being used enterprise wide. The prices set by Mosaic’s tool met helped the client meet both margin and volume goals for the sale, while saving multiple hours of the client’s manpower. Additionally, the tool is flexible enough to be applied in a variety of price-setting scenarios and has already seen further implementation by the client.

For More Information

Want to learn how to deploy machine learning for pricing? Please contact us here!